Global shipping to split into Western and Eastern blocs soon

04/23/2023 / By Arsenio Toledo

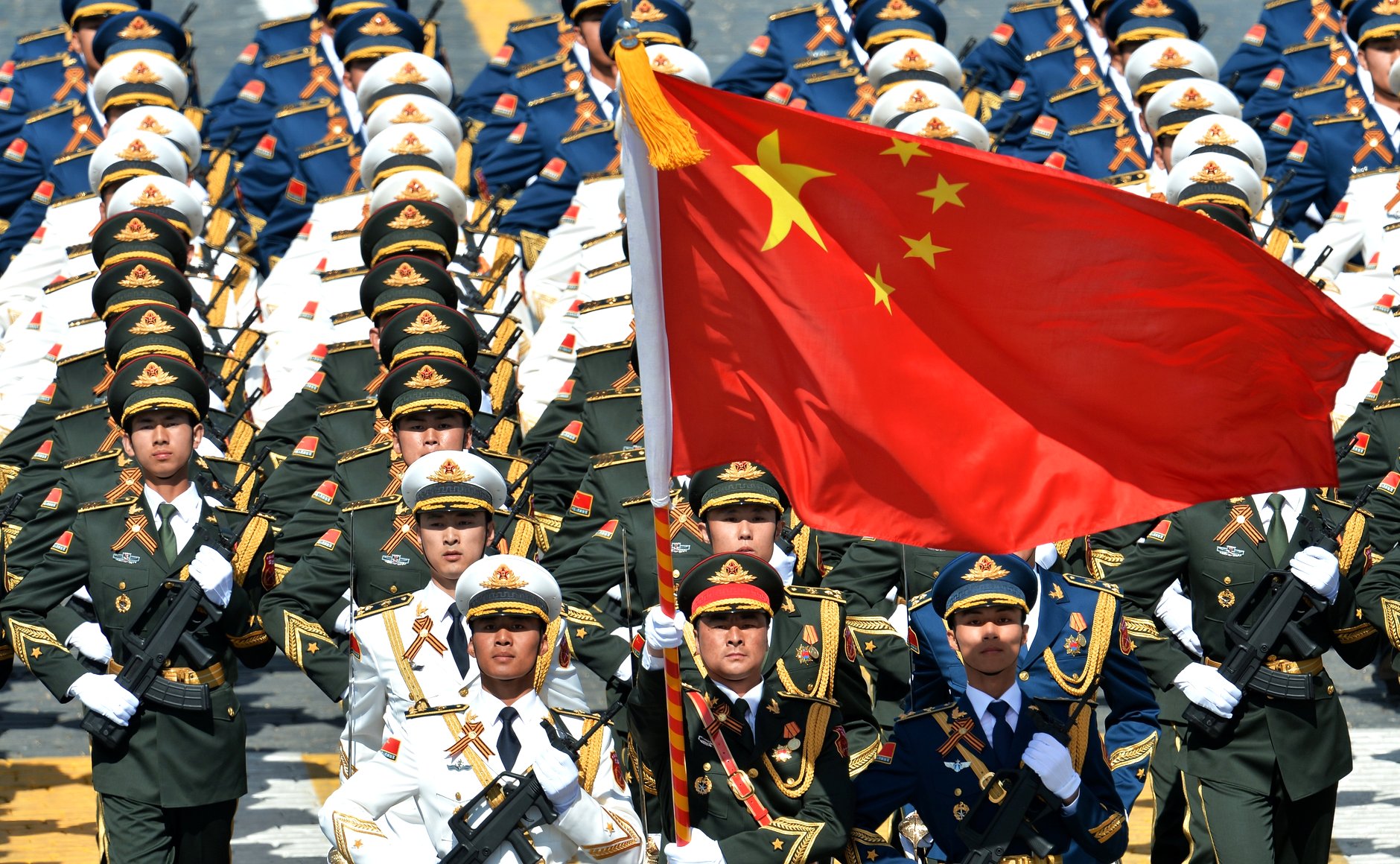

The global shipping industry is splitting into two opposing camps – a Western bloc led by the United States and the European Union (EU) and an Eastern bloc led by China and Russia.

This is according to multiple research papers published by the World Trade Organization (WTO). These papers warn about a worst-case scenario for the global shipping industry called a “long-run decoupling,” which involves the “disintegration of the global economy into two separate blocs.” (Related: Shipping cost from Asia to US West Coast drops 84% year-over-year as consumer demand plunges.)

Another research paper published by the WTO this January analyzed a worst-case scenario outcome of the geopolitical rivalries between the Eastern and Western blocs resulting in a “bipolar trade war” with severe consequences for future global GDP and trade volumes.

An assessment by the European Central Bank provides a similar warning, noting that countries may soon be “mechanically allocated” to either the Western or Eastern bloc according to their voting patterns in the United Nations General Assembly.

“In this fragmentation scenario, we assume that trade (as a share of GDP) in intermediate inputs between the two blocs reverts back to the level of the mid-1990s,” the bank’s researchers wrote.

Current geopolitical conflict points like Taiwan and Ukraine will make the possibility of the world essentially splitting up into two shipping and trading zones even more likely – unless they are resolved peacefully soon.

Short-term profits of global shipping to turn into long-term worries

In the short term, FreightWaves writer and maritime expert Greg Miller noted that further geopolitical schisms will initially be positive for shipping rates. This can be seen in the past year when the beginning of Russia’s special military operation in Ukraine rerouted Russian crude from the short-haul oil trade with the EU to long-haul runs in China and India.

Russia also found replacement buyers of diesel in North Africa, Asia and South America. Meanwhile, the EU replaced lost Russian barrels with more-distant supplies coming in from the U.S., Asia and the Middle East.

This massive shift in shipping demand has brought greater profits for shipping companies willing to make long-haul journeys. However, in the longer term, these continued geopolitical issues pose significant downsides for shipping.

The January WTO working paper noted that the higher the global GDP growth, the better the demand for oil is over the long term. Shifts in geopolitical stability as opposed to multilateral cooperation would translate into an approximately 6.4 percent GDP decrease for developed nations through 2050, a 10.2 percent GDP loss for developing nations and an 11.3 percent GDP hit for the world’s least developed countries.

This prediction by the WTO is likely to happen if current geopolitical tensions continue. This does not take into account the possibility of escalations, such as if the conflict in Ukraine gets even bloodier or if a military conflict breaks out between the U.S. and China over Taiwan. These potential conflicts are predicted to have a highly negative effect on the global economy.

“It’s a given to me that the Chinese won’t forget about Taiwan. It’s a given to me that the Chinese will go for it in the future,” said Robert Bugbee, president of shipping company Scorpio Tankers. “But it’s such an enormous thing, should it happen, that you can’t think about it on an everyday basis. You just put it in the back of your mind and get on with it, as an operator.

Oystein Kalleklev, CEO of Flex LNG, a liquefied natural gas shipping company, noted that the consequences of a future war between China and the U.S. are so enormous that it is “almost not even worth worrying about.”

“The consequences are so big,” he said. “If that happens, we’re all screwed. Russia and Ukraine would look like a small bump in the road. You would have an energy shock like you’d never seen before. The whole world economy would stop.”

Learn more about global trade at SupplyChainWarning.com.

Watch this video from “The American Journal” on InfoWars discussing how a Chinese shipping company once orchestrated the shutdown of America’s largest ports.

This video is from the InfoWars channel on Brighteon.com.

More related stories:

The climate cult is destroying international shipping … and global supply chains along with it.

Russia and China pledge friendship, denounce the West.

PLUMMET: Maritime, rail and trucking demand DROPS sharply from pandemic era peak.

LA Port’s October imports drop 28% year-over-year as labor negotiations drag on.

Freight companies expect “muted peak season” due to waning retailer demand.

Sources include:

Submit a correction >>

Tagged Under:

China, Collapse, economic collapse, economics, economy, GDP, GDP growth, logistics, market crash, risk, shipping, shipping industry, supply chain, supply chain crisis, transportation, War, World Trade Organization

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 CHAOS NEWS