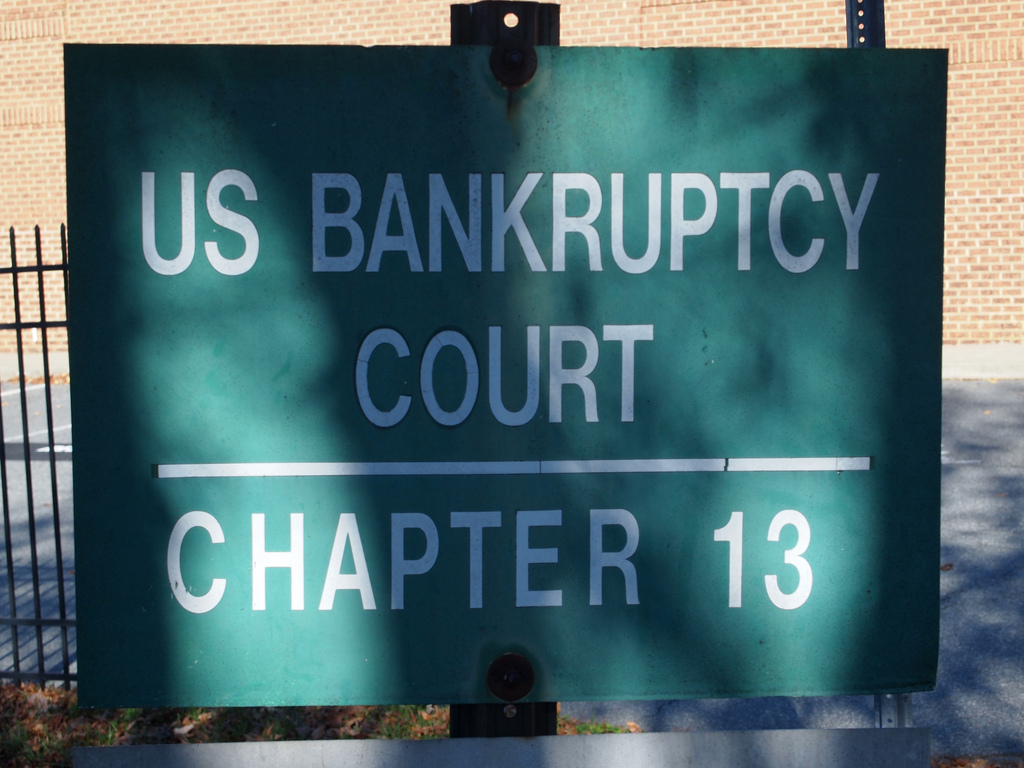

Bankruptcy filings in U.S. surge at fastest pace since 2009 as Bidenflation continues to ravage Americans, businesses

03/01/2023 / By JD Heyes

Bankruptcy filings across the United States have surged to their highest level since the last time we had a Democratic president — Barack Obama in 2009.

For the past year, the Biden administration and the Federal Reserve have been struggling to combat runaway inflation and the resulting wage-price spiral without causing a recession. However, based on the recent increase in bankruptcy filings, it seems they may soon have to admit they have failed, noted Zero Hedge on Wednesday.

A month ago, the outlet highlighted a concerning trend in the pace of large bankruptcy filings (i.e., those with over $50 million in liabilities) in the US. Specifically, Zero Hedge reported that in the first month of the year, the number of US bankruptcies exceeded 20, which was the highest for any January since 2010 when there were 25 filings, as the economy was still recovering from the Great Financial Crisis (GFC).

According to Bloomberg data, the increase in large bankruptcy filings in the US is not a one-time event, as the pace of such filings continues to surge. As of the end of February, a total of 39 large companies have filed for bankruptcy in the US since the beginning of the year, exceeding the pace seen in January. This marks the fastest rate of company bankruptcies since the aftermath of the global financial crisis in 2009, when there were 63 large filings at this point in the year.

Last week, there were seven large bankruptcy filings in the US, which included generic drugmaker Akorn’s liquidation and Covid-19 testmaker Lucira Health’s Chapter 11 filing. These filings were tied to at least $50 million in liabilities, the outlet continued.

Some of the most significant bankruptcy filings this year include Party City Holdco Inc, Serta Simmons Bedding LLC, and cryptocurrency lender Genesis Global Holdco. Additionally, the pile of dollar-denominated corporate bonds and loans trading at distressed levels in the Americas has risen to $237.2 billion in the week ending Friday, which is a 1.63% increase from the previous week’s $233.4 billion, according to BBG data, Zero Hedge added.

The Biden administration inherited a period of low inflation and an economy that was beginning to recover from the coronavirus recession under then-President Donald Trump’s pro-growth economic policies. Right off the bat, the Biden regime proposed, and the then-Democratic Congress passed, a $1.9 trillion relief package to stimulate the economy, which included rounds of stimulus checks, an expansion of the Child Tax Credit, and additional unemployment benefits.

The economic stimulus from the Biden administration is what led to an increase in inflation, according to a number of experts. That was because the increased money available in the economy drove up prices as individuals and businesses had more money to spend, and there were fewer goods to buy thanks to a supply chain crisis that still hasn’t been fixed. Inflation was exacerbated further by the additional unemployment benefits.

The Biden administration tried taking some steps to mitigate inflationary pressures. The Federal Reserve had kept interest rates low but in recent months has started raising them in an effort to slow inflation, but so far, it hasn’t had much effect.

Still, inflation is likely to remain a risk for the Biden administration. The expansionary fiscal policies and the increased money supply could lead to higher prices and slower wage growth. This could be compounded by the higher demand for goods and services, as well as the additional money given out as part of the stimulus package.

By comparison, during Donald Trump’s presidency, the US economy experienced a period of expansion. The unemployment rate reached a historic low of 3.5 percent in December 2019, and wages increased for several years. The tax cuts and Jobs Act of 2017 were credited with boosting economic growth, and the stock market reached record highs.

And importantly, bankruptcies were way down.

Sources include:

Submit a correction >>

Tagged Under:

bankruptcy filings, Biden economics, Biden policies, Biden regime, Bidenflation, Collapse, Democratic policies, dollar demiase, dollar demise, Donald Trump, economy, Inflation, inflationary economy, inflationary policies, Joe Biden, market crash, pensions, personal finances, recession, risk, supply chain, Trump economy

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 CHAOS NEWS